A staggering ₦1.3 trillion has vanished into thin air with the collapse of Crypto Bridge Exchange (CBEX), a platform that promised 100 per cent returns in 30 days through what it claimed was AI-powered trading.

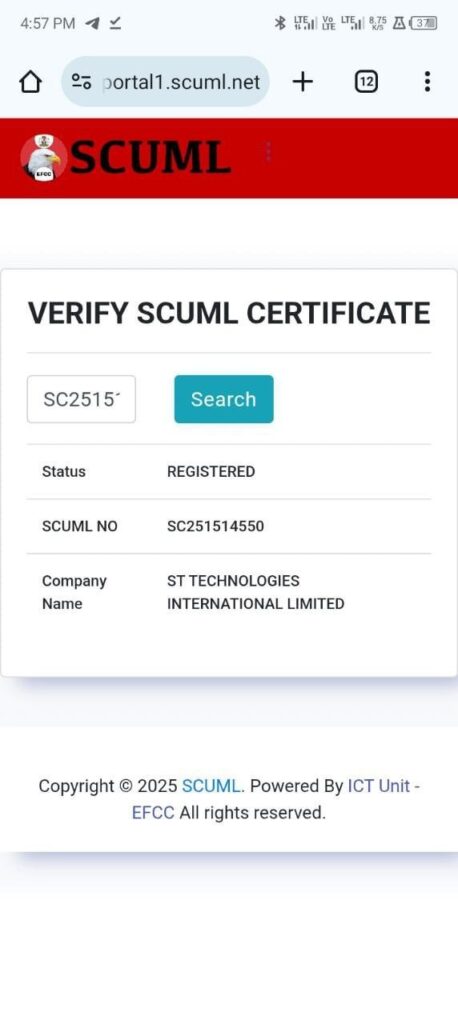

Verily News reports that CBEX is owned by a company named ST Technologies International Limited, legally registered in Nigeria and appearing legitimate enough to earn the trust of over 600,000 Nigerians, including celebrities, police officers, students, and even market women.

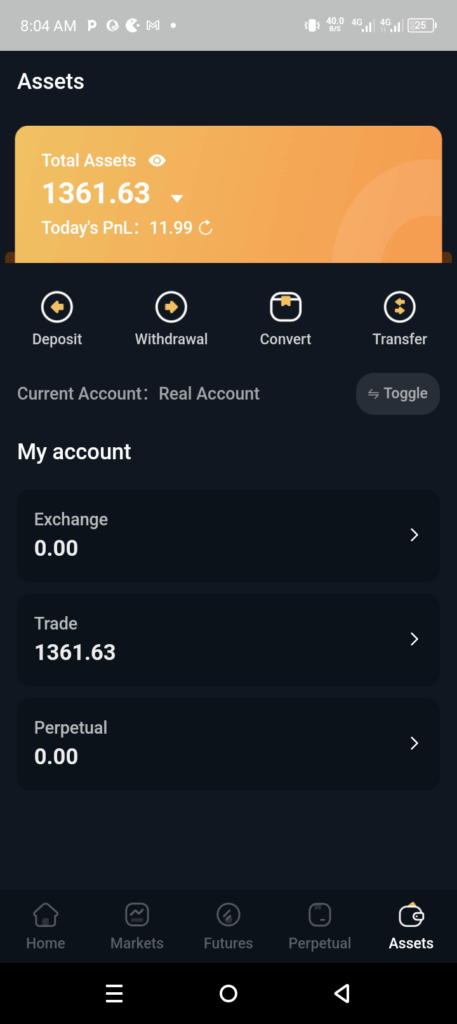

Copies of the certificates we obtained:

What made this Ponzi scheme convincing wasn’t just its paperwork. The owners ran aggressive marketing campaigns, maintained Telegram groups with over 200,000 members, opened physical offices in strategic places, and even conducted charity events. They became popular through radio jingles, social media campaigns, and school visits, luring Nigerians of all classes.

CBEX rewarded referrals and painted a “too good to be true” picture of easy wealth, one that even seasoned individuals like Fuji musician Taye Currency and high-ranking police officers fell for. Some sold their cars, took loans, or used rent money to invest. Sadly, their expectations came crashing down on Monday, with Telegram groups locked and administrators nowhere to be found.

While the EFCC has confirmed ongoing investigations and initiated steps to deregister the company, many victims are still in shock. According to reports, some investors attempted suicide, while others now face deep debts.

This development raises questions about regulatory bodies’ effectiveness, especially as CBEX wasn’t included in the EFCC’s March list of known Ponzi schemes. Human rights lawyer Inibehe Effiong called it a “serious failure,” demanding not just justice but systemic reform.

Verily News reports that the fall of CBEX isn’t just about a scam but a reflection of financial desperation, broken trust, and the urgent need for better oversight in Nigeria’s fintech and crypto ecosystems.

ALSO READ TOP STORIES FROM VERILY NEWS