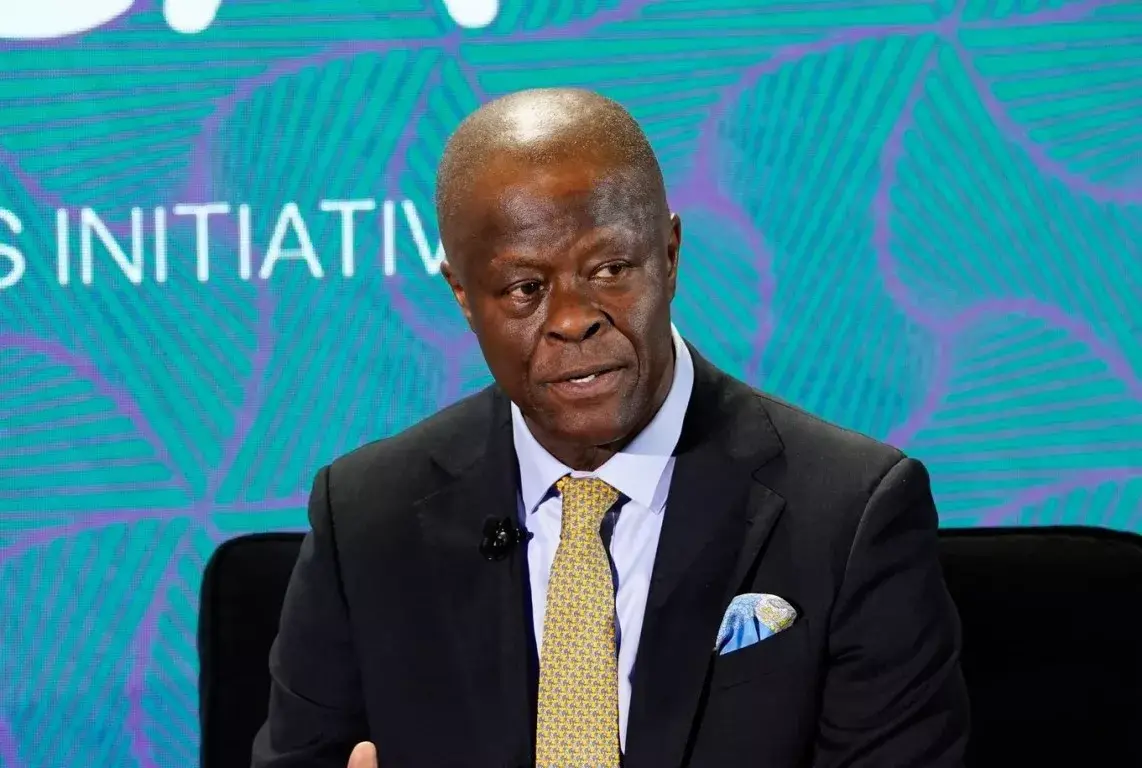

Senate President Godswill Akpabio faced criticism from the Nigeria Labour Congress (NLC), Trade Union Congress (TUC), and Nigeria Employers Consultative Association (NECA) over his remarks that only 30 per cent of Nigerians pay taxes while expecting more from the government. Speaking at a two-day public hearing on the controversial tax reform bills in Abuja, Akpabio emphasized that tax reforms were crucial for Nigeria’s future and must be properly structured.

In response, the NLC, TUC, and NECA argued that Nigerians evade taxes due to the government’s lack of accountability. Meanwhile, President Bola Tinubu, according to the chairman of the Senate Committee on Finance, Senator Sani Musa, urged the Senate to produce effective legislation from the bills he submitted on October 3, 2024.

Various stakeholders, including the Nigerian National Petroleum Company Limited (NNPCL), Revenue Mobilisation and Fiscal Allocation Commission (RMFAC), National Association of Chambers of Commerce, Industry and Agriculture (NACCIMA), Arewa Think Tank, and Retired Permanent Secretaries, voiced support for the bills. The Institute of Chartered Accountants of Nigeria (ICAN), Chartered Institute of Bankers, Market Academy of Nigeria, Ministry of Trade and Investment, and Association of National Accountants of Nigeria (ANAN) also backed the proposed reforms.

At the public hearing, the Arewa Think Tank, led by its convener Muhammad Yakubu, dismissed claims that the northern region was opposed to the bills. The tax reform bills under review include the Nigeria Tax Bill (NTB) 2024, the Nigeria Tax Administration Bill (NTAB) 2024, the Nigeria Revenue Service (Establishment) Bill (NRSEB) 2024, and the Joint Revenue Board (Establishment) Bill (JRBEB) 2024. These bills, which passed a second reading in the Senate on November 28, 2024, were forwarded to the Committee on Finance for further legislative input.

Akpabio, while opening the public hearing, stressed the importance of getting tax reforms right, describing them as critical to the nation’s economic future. He assured that the Senate would not rush the process, stating that a detailed clause-by-clause review would be conducted before the bills are passed.

Expressing concern over Nigeria’s poor tax culture, Akpabio lamented that only a small fraction of Nigerians contribute to government revenue while demanding improved infrastructure, education, and security. He emphasized that tax laws should serve the best interests of the country and pledged that the National Assembly would strengthen its oversight functions to ensure government resources are used judiciously.

Urging Nigerians to engage constructively with the tax reform process, Akpabio noted that in other countries, citizens face penalties for certain behaviors, including speeding, while such measures are absent in Nigeria. He called for a reassessment of tax laws and criticized the reliance on social media for uninformed opinions, advising people to analyze the bills before forming judgments.

He reiterated that the Senate was committed to making informed legislative decisions, engaging stakeholders, and ensuring tax policies promote economic growth. Stressing the need for modernization, he pointed out that some existing tax laws date back to colonial times and require urgent updates to align with contemporary economic realities. He also noted the need for tax compliance to be simplified and fair, ensuring that revenue distribution benefits all regions equitably.

Highlighting the issue of revenue allocation, he cited the example of a brewery operating in Ogun State but paying taxes in Lagos, emphasizing that tax revenue should benefit the areas where businesses operate. He encouraged stakeholders to review the bills thoroughly and submit well-reasoned recommendations instead of relying on social media debates.

Chairman of the Senate Finance Committee, Senator Sani Musa, in his remarks, stated that President Tinubu had instructed him to ensure the tax reform bills result in effective and enforceable legislation. Musa emphasized that the process would be inclusive, aiming to produce a framework that enhances revenue collection, encourages investment, and ensures economic prosperity. He reassured stakeholders that concerns about unfair revenue allocation would be addressed.

Group Chief Executive Officer of NNPCL, Mele Kyari, expressed satisfaction with the bills, describing them as crucial for streamlining taxation and making the industry more efficient. Chairman of the Revenue Mobilisation and Fiscal Allocation Commission, Dr. Mohammed Shehu, also supported the reforms, highlighting their potential to bring economic stability while urging better revenue distribution to states.

Muhammad Yakubu, convener of the Arewa Think Tank, dismissed claims that the North was opposed to the bills, stating that the group had analyzed their benefits and supported the reforms. The Supreme Council for Sharia in Nigeria also acknowledged the need for tax reform but recommended that the Value Added Tax (VAT) rate be reviewed to either five percent or remain at the current 7.5 percent.

Reacting to Akpabio’s comments, the Nigeria Labour Congress argued that an unaccountable government cannot expect citizens to willingly contribute their resources. A senior NLC official stated that tax compliance is only feasible when people see tangible benefits from government actions. He criticized politicians for making statements without considering the realities of governance, pointing out that despite significant revenue from oil and other resources, government officials live extravagantly while the masses struggle.

He argued that taxation should be based on wealth creation rather than imposed on struggling citizens. He emphasized that only formal workers consistently pay taxes, while the wealthy often evade them. According to him, the government should focus on creating an enabling environment for wealth generation rather than burdening low-income earners with excessive taxes.

The Trade Union Congress (TUC) also challenged Akpabio to name Nigerians who evade taxes rather than making broad claims.